[ad_1]

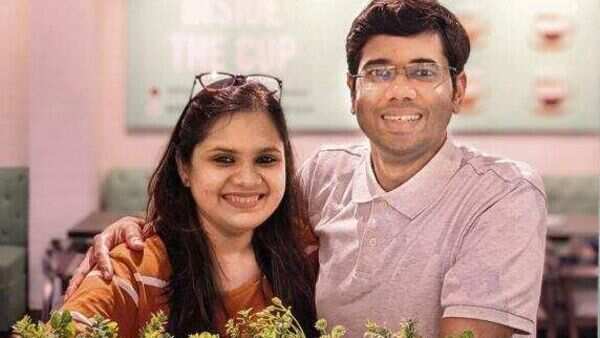

Mayank Dhingra and his wife Neha Lalwani are getting ready to celebrate the first anniversary of their new home, which they bought last year. Dhingra, an automotive journalist, and Lalwani, a computer science teacher, moved into the flat on 20 November 2021. They had been house-hunting since June, and the Delhi-based couple finally found a flat in Shalimar Bagh in West Delhi in August 2021 that far exceeded their expectations.

House-hunting

“We wanted a sense of security and did not want the hassle of haggling with the landlord over the rent every year,” Dhingra says, explaining why they chose to buy a flat rather than rent one. “We have put our heart into decorating our home, something we wouldn’t have done with a rented apartment.”

The 32-year-old couple began house-hunting by zeroing in on localities that were in close proximity to the school where Lalwani teaches in Pitampura, as well as their parents’ homes. That meant, finding a house close to Pitampura or Shalimar Bagh. At the same time, given their budget of ₹50 lakh, they decided to look in other areas as well. “One of the first flats that a property dealer showed us in Rohini was a bit far. It would take my wife around 30 minutes to reach her school from there,” says Dhingra. Then, they searched for flats in Sector 24, Rohini. “Here the dealers were asking for ₹60 lakh for under-construction 1-BHK flats. The bus and metro connectivity was better from here,” says Dhingra.

Surprisingly, their search eventually led them to the upmarket Shalimar Bagh area which they had originally avoided. “If you look properly, you will be able to find some budget-friendly societies in Shalimar Bagh. My wife and I contacted a property dealer who took us to the AG block. We immediately took a liking to the 1-BHK flat he showed us,” says Dhingra. “It was in good condition and all the woodwork was intact. The balcony overlooked a beautiful garden and there were no buildings in front of it.”

Taking professional help

By sheer luck, Dhingra and his wife were able to negotiate a good price. “A property dealer known to my father-in-law happened to know that the owner of the flat was keen on its immediate sale,” says Dhingra. This helped the couple strike a deal at ₹36.5 lakh for the 400 sq.ft apartment. Since they got the flat registered in Lalwani’s name, they had to pay a lower stamp duty of 4% (concessional rate for women), plus the registration fee of 1%. Had the property been registered in their joint names, it would have attracted a higher stamp duty of 5%, and 6% if it was bought in Dhingra’s name.

As to why he chose property dealers for the deal, Dhingra said, “Considering the complexity and the considerable amount of money involved in buying property, it helps to have someone whom you can turn to for any help.”

View Full Image

He says that property developers, as part of their business, have a network of right contacts and understand the pulse of the market. Mayank paid ₹25,000 to the property dealer for his services. Typically, you are charged 1% of the flat price.

Mayank and his wife also did a background check of the flat by speaking to neighbours and scanning the list of unauthorized construction properties for the area on the Municipal Corporation of Delhi website.

Housing loan hiccups

Dhingra and his wife did face a stumbling block when the flat owner insisted on a part payment for the apartment in cash ( ₹16.5 lakh of the total ₹36.5 lakh). This impacted the couple’s loan eligibility. Dhingra and his wife had planned to use ₹12 lakh of their savings, and take a loan of ₹30 lakh to cover the flat’s price, including the cost for furnishing it. “With the registered value of the flat at only ₹20 lakh, getting a ₹30 lakh loan was difficult. SBI, the first bank that we reached out to, was giving a loan of only 80% of the registered value,” says Dhingra. Then, they approached ICICI Bank which extended them two joint loans – a home loan of ₹20 lakh and a home renovation loan of ₹10 lakh. The processing and legal fees came to ₹19,000 for both the loans.

But a big disadvantage was that the couple could only claim a smaller amount than would have otherwise been possible as tax deduction. Under Section 24 of the Income Tax Act, you can claim deduction of up to ₹2 lakh per year on your home loan interest payments. This benefit does not apply to home improvement loans.

With interest rates inching up – from 6.8%, when the loans were sanctioned to the couple, to almost 8% now–Dhingra is using every opportunity to part pre-pay his loan. “I will keep pre-paying the home improvement loan as there is no tax benefit on it,” he adds.

Download The Mint News App to get Daily Market Updates.

[ad_2]

Source link