[ad_1]

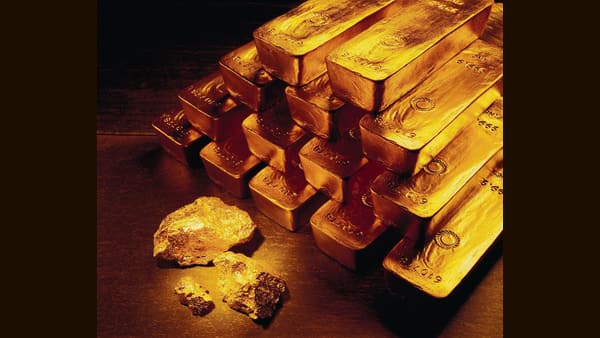

NEW DELHI: Gold is among the most prized assets Indian households typically possess. To keep it safe, it is best to keep gold in a secured locker. In order to enable customers to safeguard their physical gold at an affordable price, Muthoottu Mini Financiers, one of the leading non-banking finance companies (NBFC) in India,has launched Safe Lock Gold Loan, a first-of-its-kind facility that enables customers to avail the benefits of a locker by pledging any quantity of gold for a minimum loan amount of ₹100.

The Safe Lock Gold Loan facility has been introduced to ensure that customers receive the benefit of affordable and convenient choice to secure their physical gold while obtaining a minimum loan amount. The annual charges for utilising this facility is ₹300, making it a cost-effective. Customers will have insurance coverage for pledged gold jewellery, which is one of the distinctive aspects of Safe Lock Gold Loan. The main benefit of this product is that customers can apply for credit based on their gold kept in the safe lock, which can be obtained at any time through online and offline channels and repaid online or offline as per the customer’s convenience.

“With Safe lock Gold Loan, we intend to empower and safeguard physical gold of each and every individual with the added benefit of availing a loan amount. We strive to understand our customers‘ needs and direct our valued services as per their requirements in these changing times. We are well on our way to becoming the most preferred and one-stop financial services provider for the common man across India,” said Mathew Muthoottu, managing director, Muthoottu Mini Financiers.

The Safe lock Gold Loan facility will be available in select branches of Muthoottu Mini Financiers across zones for the time being and will be made available in all the 840 plus branches of Muthoottu Mini Financiers spread across Kerala, Tamil Nadu, Karnataka, Andhra Pradesh, Telangana, Haryana, Maharashtra, Gujarat, Delhi, UP, Goa and the Union Territory of Pondicherry by the mid of November 2022.

Download The Mint News App to get Daily Market Updates.

[ad_2]

Source link