Personal Loans are one of the popular types of loans among borrowers. These loans are flexible, easy to obtain, and do not require collateral. They can also be utilized for different purposes. The fund can be used for an international trip, for the wedding of your dreams, to upgrade your qualification, or for any other personal use.

Lending institutions like Clix Capital provide Personal Loans to salaried professionals at low rates, but are you aware that India has specific laws governing Personal Loans and Personal Loan eligibility? The RBI’s guidelines for Personal Loans aim to safeguard the rights of the borrower’s financial interests.

Personal Loan Terms & Conditions

-

Use and Security

Unlike medical emergencies or travel loans, Personal Loans are not constrained by a predetermined purpose. It is much easier to apply for an instant personal loan. Additionally, collateral or security is not required for Personal Loans.

-

Eligibility

Personal Loan eligibility requirements are designed to ensure borrowers can afford to repay the same. The eligibility requirements may vary. The following are some of the common factors considered for eligibility.

-

Age Range

Most financial institutions offer loans to borrowers between the ages of 21 and 58. This is because most people in this age bracket may be able to repay the loan as they might have a steady income source.

-

Monthly Income

Among the necessary eligibility conditions is that the borrower should be a salaried professional with a decent monthly salary. Clix Capital offers Personal Loans to salaried professionals having a minimum salary of Rs. 20,000.

-

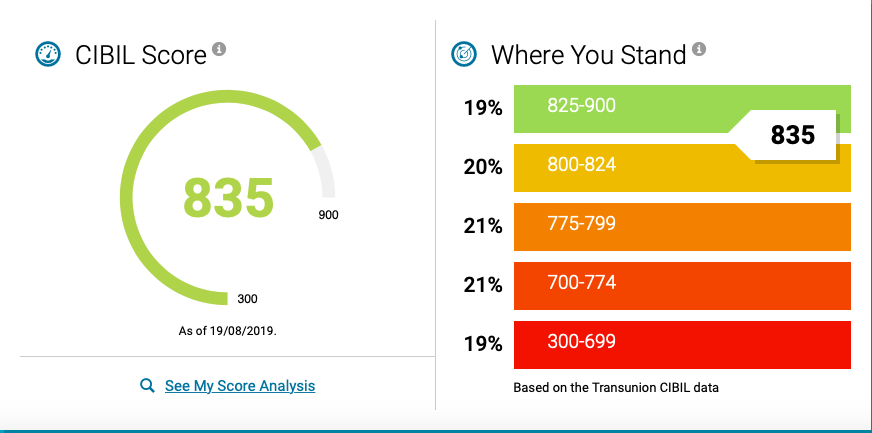

Credit Scores

Credit score can determine the creditworthiness of a person. Your chances of acquiring a Personal Loan at a decent interest rate increase with your credit score. A person with an Experian credit score of 630 and above is eligible for a Personal Loan without collateral.

It becomes challenging for applicants with poor credit scores to apply for an instant loan. To apply for the loan, such applicants can include a co-applicant with a good credit score.

Personal Loan RBI Rules

The RBI has outlined certain rules to ensure the procedure is fair to both sides. Here are a few highlights for your convenience.

- All loan application forms must be thorough and contain all pertinent details about fees and payments.

- Loan applications must be verified within a reasonable amount of time.

- If loan requests for less than Rs. 2 lakhs are denied, the grounds for the rejection must be stated by the lending institution in writing.

- Loans must be disbursed on time, and any modifications to the terms or conditions must be disclosed to the borrower.

- Lending institutions must provide borrowers adequate notice before recalling, canceling, or requesting speedier repayment.

- Unless expressly permitted by the loan contract terms, lending institutions are not permitted to interfere in the borrower’s life.

- Lending institutions should not make distinctions based on caste, religion, or sex.

- Additionally, lending institutions are not permitted to pester the borrower regarding debt recovery.

Conclusion

The borrower must fulfill the personal loan eligibility criteria requirements for the process to be hassle-free and convenient. Several additional requirements and directives are provided by the RBI, all of which safeguard the interests of the lending institutions and the borrowers.

Nowadays, the process of obtaining a Personal Loan has become simpler. However, it is important to understand all the details regarding a Personal Loan before committing to it.