The Credit Information Bureau (CIBIL) score is a major aspect in determining your eligibility for various credit products including loans and credit cards. Your score is just one criterion among many that banks and other lending organizations evaluate when deciding whether or not to extend credit to you. Therefore you should know how to cibil score check and the major factors that affect it.

What is a credit score?

Credit scores are numeric representations of the information included in credit reports that are used to make predictions about a person’s credit behavior, such as the probability that they will repay a loan on time. Mortgage, credit card, and auto loan approvals, as well as tenant screening and insurance premiums, all make use of credit ratings. Your credit score and score from other credit reporting agencies are also utilized to set your interest rate and credit limit. Your cibil score calculation is done by a company using a complex formula (a scoring model) based on the information included in your credit report in your cibil account.

Major factors that affect your CIBIL score

Erratic payment behavior and history

The primary factor in determining your score is your payment history. Make sure to always make your monthly payments on time, especially if you have any recurring debt like a credit card or loan. A CIBIL study by cibil score calculation found that a 30-day late payment can knock 100 points off of your score. Setting up alerts and reminders in your cibil account might help you avoid late or missed payments on several loans and credit cards. Inconsistency in your repayment of credit, as seen by missed or late payments, will negatively affect your credit score.

High Percentage of Available Credit

Watching your debt-to-income ratio is a must. A credit utilization ratio measures how much of your total credit you’ve really used by cibil score calculation. It is recommended by financial advisors that you use no more than 30% of your available credit at any given time. A good rule of thumb is to spend no more than 30% of your available credit (Rs. 1 lakh in this case). Your credit score may take a hit if you have used more than half of your available credit. Lenders will view you with suspicion if your credit exposure is large, as this is an indication that you are more likely to default on your debts.

Submitting a Large Number of Credit Application

Credit reports are pulled by potential lenders when a person applies for a loan or credit card. It’s a serious question, so to speak. Inquiries into your cibil score calculation and credit report will be made simultaneously by multiple institutions if you put out multiple applications. Tough questions are reported and have a negative impact on your score. It will make you appear desperate for earning credit points.

You should wait before applying for new credit if you have just been denied a loan or credit card. Get your CIBIL score up and try again.

Now that you know the important factors that affect your cibil score, you should also learn about how to cibil score check so that you have the required knowledge about the basics of CIBIL scores.

How to check cibil score?

An online CIBIL score check is possible. Here’s a detailed instruction on how to cibil score check:

- Visit the official CIBIL website.

- Complete the form with your name, phone number, and email address, then go to the next step.

- The form requires further information, including your PAN number.

- Ensure that your PAN details are entered accurately to advance to the next step.

It is essential to enter accurate responses to all queries regarding your loans and credit cards. On the basis of the information you provide, your CIBIL score and credit report will be calculated. And thus, your cibil account will be created and you’ll be able to check your cibil scores from time to time, very easily.

Who calculates your CIBIL score?

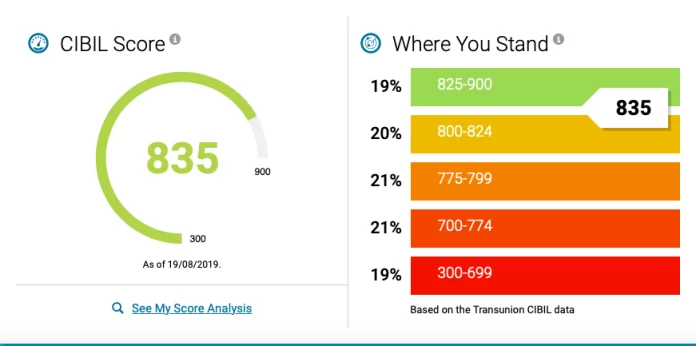

How do you think the cibil score calculation is done? A CIBIL score is a three-digit number that evaluates a person’s creditworthiness. It has a range of 300 to 900 and is computed by the TransUnion CIBIL credit bureau after numerous factors are considered.

It is important to understand that one of the elements that lenders take into consideration when deciding whether or not to approve your application is your CIBIL score. As a result, you should implement the appropriate strategies in order to keep your credit score high. At the moment, there are a multitude of lending institutions that provide consumers with favorable pricing options if they have a good CIBIL score. You have the ability to negotiate better deals on credit cards and ask for cheaper interest rates on loans if you have a good credit score by cibil score calculation.