In the world of managing money wisely, where each choice can mold your financial destiny, grasping the details of investing is crucial. A key player in this financial arena is the Loan-to-Value (LTV) ratio. This article aims to unravel the mysteries of the LTV ratio, showcasing its role as a strategic instrument for boosting investments. We’ll specifically focus on its application in areas such as loan against property and balance transfers. So, let’s dive into the simplicity and effectiveness of the LTV ratio, understanding how it can positively influence your investment strategies.

Understanding the LTV Ratio

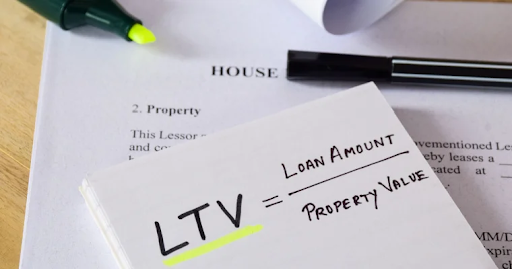

The Loan-to-Value ratio is a financial tool gauging the relationship between a loan amount and the appraised value of the property used as collateral. This metric is crucial for lenders, aiding them in evaluating the risk linked to a specific loan. For borrowers, having a solid grasp of the LTV ratio is a key that opens doors to strategic financial planning. It provides insight into the risk landscape and empowers individuals to make informed decisions, contributing to a well-thought-out financial strategy.

Why Does LTV Ratio Matter?

The LTV ratio significantly impacts investment decisions, particularly in loans against property. Whether applying for a loan or considering a balance transfer, the LTV ratio is pivotal. A higher ratio indicates a larger loan relative to the property value, offering more funds but posing increased risk for lenders. Conversely, a lower ratio reflects a cautious approach, with the loan amount being a smaller fraction of the property value, reducing risk for lenders. Striking a balance between these ratios is crucial for making well-informed financial decisions.

Use of LTV Ratio for Maximizing Investments

Optimizing Loan Against Property (LAP) Applications:

When applying for a loan against property, understanding the LTV ratio empowers borrowers to evaluate the maximum amount in line with the property’s value. By strategically using this ratio, individuals secure funds while staying within acceptable risk limits. This ensures a careful balance between obtaining necessary financial support and practicing prudent risk management, fostering a secure and well-thought-out financial strategy.

Balance Transfers and LTV Ratio:

When contemplating a balance transfer for an existing loan against property, the LTV ratio becomes pivotal. Assessing the current LTV ratio enables borrowers to negotiate with potential lenders. This strategic move may result in lower interest rates, reduced monthly payments, and an overall improvement in financial well-being. Managing the LTV ratio during a balance transfer not only refines loan terms but also enhances overall financial sustainability.

Loan Against Property Apply Online

In today’s digital era, securing a loan against property has undergone streamlining, providing a blend of convenience and efficiency. Online platforms present a user-friendly interface, allowing borrowers to kickstart the application process, upload essential documents, and monitor the application’s status.

This digital transformation not only simplifies the application steps but also quickens the approval timeline. The online shift ensures a smoother and more accessible experience for applicants, aligning with the technological advancements of the times.

Step 1: Start your journey by exploring different lenders providing loan against property services. Evaluate interest rates, terms, and customer reviews to select a trustworthy and fitting lender.

Step 2: Many lenders offer an online property loan eligibility calculator. Utilize this tool to check if you qualify, considering factors such as income, property value, and loan amount.

Step 3: Get ready with essential documents like proof of identity, address, income, property papers, and other necessary financial records. Note that the exact requirements may differ depending on the lender.

Step 4: Visit the chosen lender’s official website and go to the loan against property section to get details on the application process.

Step 5: Fill out the online application form with precise and current details. Be ready to furnish information about your personal details, income, employment, and the property you plan to mortgage.

Step 6: Utilize the online portal to upload the necessary documents, making sure they are clear and meet the lender’s requirements.

Step 7: After submitting your application and documents, the lender will review them. The duration of this process may vary based on the lender’s procedures.

Step 8: The lender will then assess the property’s current market value through a valuation, a crucial step in determining the Loan-to-Value (LTV) ratio.

Step 9: If the review and valuation are successful, the lender will approve and provide a loan offer. Thoroughly examine the terms, interest rates, and repayment conditions.

Step 10: If you find the offer acceptable, confirm it through the online platform. The lender will then proceed to disburse the loan amount, either through a cheque or direct bank transfer.

Step 11: Arrange the repayment method according to the lender’s instructions, usually by providing post-dated cheques or authorizing electronic fund transfers.

Conclusion

In conclusion, view the LTV ratio as a compass in your financial journey, guiding optimal investment choices. Unraveling its complexities opens doors to opportunities aligned with your goals, ensuring a robust and secure economic future.