Your kitchen is more than just a cooking space, it’s the heart of your home. A well-designed kitchen not only looks great but also makes daily life smoother and more enjoyable. Unfortunately, many homeowners make design choices that seem trendy or convenient but can actually cause long-term frustration. Here, kitchen design experts share six common mistakes to avoid, helping you create a space that is both stylish and practical.

1. Ignoring the Kitchen Work Triangle

The kitchen work triangle, the relationship between your sink, stove, and fridge, is a classic principle for a reason. Ignoring it can lead to constant backtracking and cramped movements while cooking.

For example, placing your fridge far from the prep area or isolating the stove from the sink can slow down meal preparation. A functional work triangle ensures everything you need is within easy reach, making cooking and cleaning a breeze.

Tip: Keep the triangle compact but unobstructed. Avoid placing appliances behind doors or in tight corners.

2. Choosing the Wrong Cabinet Layout

Cabinets are essential for storage, but poor planning can make them more of a hindrance than a help. Overcrowded layouts, deep cupboards, or doors that clash with other elements can limit accessibility and efficiency.

Many homeowners go for style over function, picking fancy designs that are hard to open or require bending and stretching. Instead, focus on a layout that maximises space without making the kitchen feel crowded. Pull-out drawers, lazy Susans, and well-planned pantry spaces can make a huge difference.

Tip: Always map your kitchen traffic flow before finalising cabinet placement.

3. Overlooking Lighting Essentials

Good lighting is more than just overhead lights. Task lighting over countertops, ambient lighting for the general area, and accent lighting for design elements all play a part in a functional kitchen.

A dimly lit kitchen can make cooking dangerous, hide messes, and make your space feel smaller. Avoid relying on a single ceiling fixture. Layered lighting not only improves visibility but also adds warmth and style.

Tip: Consider under-cabinet lights for prep areas and pendant lights over islands for both function and aesthetics.

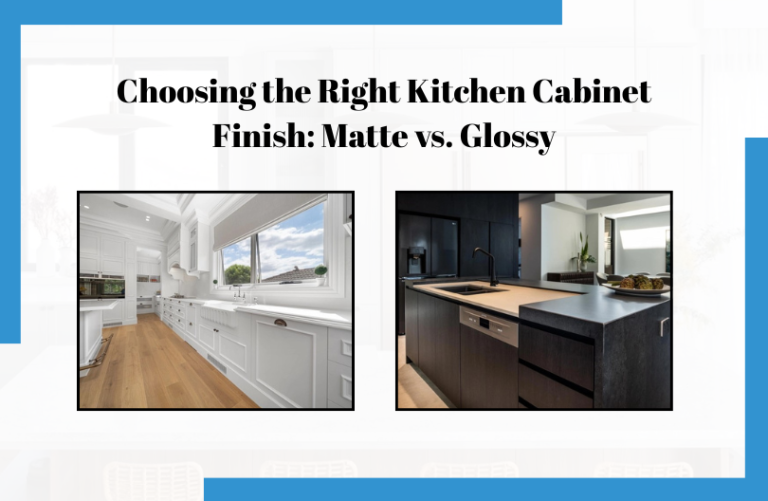

4. Opting for Trendy Over Timeless

It’s tempting to jump on the latest kitchen trend, whether it’s bold colours, unique backsplashes, or unusual materials. But trends fade, and what looks fresh today may feel outdated in a few years.

A timeless design combines functionality with neutral, classic elements. Think practical layouts, durable materials, and finishes that complement your home’s style. You can always add small, trendy touches that are easy to change, like cabinet handles, decorative tiles, or colourful accessories.

Tip: Invest in core elements that last, and layer trends through removable or low-cost features.

5. Neglecting Countertop and Workspace Needs

Countertops aren’t just surfaces; they’re your main workspace. Skimping on space or choosing materials that scratch, stain, or burn easily can turn cooking into a chore.

Many kitchens underestimate the amount of prep space required for everyday tasks. Even a small kitchen benefits from a clear, sturdy workspace. Think about how you cook, bake, or entertain, and plan countertops accordingly. Durable surfaces like stone, engineered quartz, or high-quality laminates can provide longevity without sacrificing style.

Tip: Include a mix of prep, cooking, and serving areas to ensure your kitchen can handle any task efficiently.

6. Skimping on Quality Materials

Cutting corners on materials might save money upfront, but can lead to costly repairs and replacements later. Low-quality cabinets, flimsy hardware, and cheap flooring often wear out faster, affecting both function and aesthetics.

Experts recommend investing in materials that stand the test of time. Solid cabinet construction, quality hardware, and durable finishes not only improve the lifespan of your kitchen but also add value to your home.

Tip: Choose materials that suit your lifestyle. If you cook frequently, prioritise durability; if you entertain often, focus on style that withstands heavy use.

Final Thoughts

Designing a kitchen is more than picking colours and appliances, it’s about creating a space that works for you. Avoiding these six common mistakes can save you frustration and make your kitchen a true hub for daily life.

If you’re planning a kitchen renovation , working with experienced designers can make all the difference. Custom kitchens allow you to tailor every detail to your lifestyle, from smart storage solutions to practical layouts. Whether you’re after a modern, sleek space or a warm, classic kitchen, investing in thoughtful design now will pay off for years to come.