[ad_1]

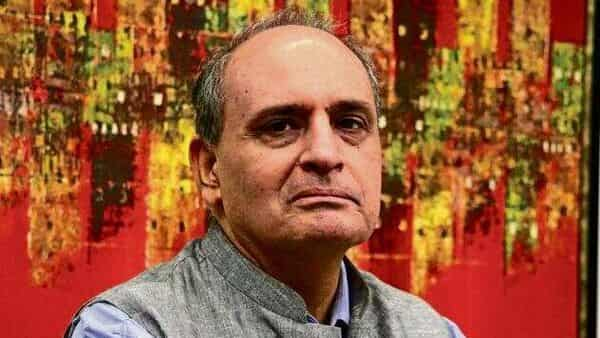

“I was fairly bright as a student at St. Columba’s School. My father played for the Rest of India versus the West Indies cricket team, one step away from test cricket. I was a reasonably good cricketer too, but since I got admission to bachelor of commerce (honours) in SRCC, I stuck with that,” reminisces 59-year-old Bhasin, who is the director at IIFL Securities Ltd.

After college, Bhasin cleared his chartered accountancy course. “I did about two years of LLB, but did not complete it as I was by then bitten by the stock market bug,” he recalls.

Bhasin started going to the trading floor in 1985. “In my life, I’ve had no second choices, only the stock market. And that’s why I withstood all the trials and errors over a period of 33 years,“ he says.

Prior to IIFL, Bhasin was the director at Deutsche Bank as well as the HB Group. Bhasin, who designed model portfolios, which are available on platforms such as Smallcase for retail investors , personally manages large portfolios of high-net-worth individuals.

Bhasin shared his portfolio details, investment strategy and financial journey for the special Mint series Guru Portfolio. Edited excerpts:

Do you remember the first few stocks that you bought?

In the initial days, I was very keen on holding MNC (multinational company) stocks, and, at that time, pharma MNCs were very much in demand. Glaxo was available for ₹30. This is one stock which made me a lot of money. Also, one of my father’s friends suggested Ponds. That stock was trading at ₹55 at that point and seven or 10 years later, the firm got merged with Lever. Today, it is worth around ₹55,000, and the Ponds brand is still going strong. There were a lot of mistakes, too, that I made over a period of time.

Which were the stocks where you took a hit?

The first stock in which I burnt my fingers was Lohia Machines Ltd (LML), and it was a forward derivatives stock. Also, there was an urge to get into initial public offers. There were listing pops of course, but the gains were not sustainable as it was the era of crony capitalism, meaning that promoters were shady and wanted to play the markets. The big learning from this: don’t trust easy money.

Was there any investment strategy that you followed in the initial days?

I followed a very simple principle: if I have to make capital, I have to be trading. So, I did the trading side, which is the badla (carry-forward) system, and whatever I earned from that, I invested in good stocks. In my early days, there was an arbitrage between Delhi, Bombay and Calcutta, and most of the MNCs were traded in Bombay. We used to use this arbitrary window to get odd lots cheaper in Delhi. I used to do a lot of odd-lot accumulation at a 30-40% discount. It worked for some time, but then I learned the hard way that speculation was harmful. And I realized that portfolios are necessary if you have to build long-term wealth.

When did you start investing seriously?

Soon after, I became a big institutional broker at the firm of my uncle, a legendary stockbroker and the president of Delhi Stock Exchange. I went to Bombay, and started learning what institutions buy and how they operate. I started in 1992 and continued till 2001-02 as an institutional broker. UTI India fund was the only foreign fund, and in 1999 I bought 7 million shares of Hindustan Zinc from them at ₹9 each, and in the end, it went to the promoter. I made some money but also learned how portfolios were allocated and where you could make a killing.

What is your investing strategy?

If I handle a client portfolio today, I would give them stocks that last. As for investments, 50-55% is always in large-caps, run-of-the-mill stocks or those that have always performed. Second, I like to keep 30% cash because that gives me plenty of small trading opportunities.

What’s your current asset mix?

As a compliance measure, I cannot trade on my own and I don’t do much of the investments. But I am an equities man even today. I’m 59 years old, but I will not go below 65% in equity. The debt component would be 10-12% and gold as an asset around xx% but my real estate holding has started to go up. So, whatever capital I have created in the last three-four years has gone into real estate. On the alternatives side, my biggest investment would be my stock options. I don’t delve into other avenues because of compliance reasons.

How do you zero in on a stock?

First, I don’t look at anything else except market cap. Then, I go to the balance sheet and the parameters, and then check if the promoter is from a pedigree background. These are the three necessities. Even if the promoter has a problem because of debt or restructuring, I will not hesitate as long as his or her credentials are good and I get the right valuation. So, the valuation comfort has to be there.

Do you have any preference when it comes to market caps?

No, it depends on the risk-taking appetite and the capital that I can process. If I do choose a mid-cap stock, which can make me money, then I will go the whole hog with a big investment. I won’t put small money.

What would be your top stock performers?

In 1988, one of my uncles suggested that I buy Tata Honeywell, which had just got listed. The company was in the ratio of 51:49 between Honeywell and the Tatas. I picked up 1,000 shares and upon that I got a rights issue at ₹35 in the ratio of 5:3. So, I got 1,650 shares at an average price of ₹40-43. In seven years, the stock jumped to ₹760, and in those five-seven years, I could buy my first house. So, the capital which came from that stock was huge. The only mistake I made is that today I have only 275 of those shares and the price of Honeywell has soared to ₹45,000. The other big stock would be Havells, which has created a lot of wealth and is still there in my portfolio. From less than ₹1,000 crore, the company is now worth about ₹35,000-40,000 crore. And I still think they can double their value from here.

Have these stocks have contributed the most to your wealth?

Yes, surely. Also, Ashok Leyland, which I bought at ₹18, became a 10-bagger stock for me. I have IndusInd Bank since the time it was under ₹100. In the last five years, I have not churned my portfolio much. What is being done now is through mutual funds because of the compliance issue.

Are there any sectors you’re bullish on?

IT took a backseat earlier this year even though it’s the best alibi to a weak rupee, and we thought pharma would be a good substitute. Hence Sun Pharma and Cipla became a part of our portfolio. We also realized that banks are having a very good liability franchise, and large lenders are gaining more market share, hence Kotak Mahindra Bank and ICICI Bank got more space.

One strategy that worked for you, and one that didn’t?

The problem is that sometime you get wedded to a stock, and even though those stocks rise much more than what you expected, you hold on to them. But I later realized that if you have to make money and be in the market, you will have to constantly apprise yourself of the changing parts of your business. So, I think adaptation has been my mantra. But, never stay wedded to a stock as there will always be another entry point. If you have learned to make money, you must take home your profits.

Do you invest in international stocks?

When I was with Deutsche Bank, I bought some Citibank stock in a distress sale because of the issues with Lehman Brothers. And that turned out to be a five-bagger in the next three years. I have not done any overseas investments after that.

How many months of emergency fund do you provision for?

Capital is not an issue, but I do keep cash in my account. Twenty years ago, though, it was always hand-to-mouth, in the sense I was always fully invested not knowing what tomorrow will be like. The idea of holding cash has come into my financial planning only in the last five years.

I have sufficient cash in the bank now to last for at least eight to 12 months.

Are there any lifestyle changes that you made during the covid pandemic and is set to become permanent now?

I didn’t imagine that so many people would take to TV during the lockdown, which made me a hero as I was one of the few people who called the Nifty bottom at the 8,000 level. That has put a lot of pressure on me in terms of giving a call. The second thing, which I learned from covid, was that it is necessary to always keep more cash in hand as emergencies like this have never been witnessed in history. And third, the reluctance to spend has gone away.

What does wealth mean to you?

Wealth is just the means to an end. I’m not a person who’s very possessive about things. The market has taught me that life and markets coexist if you know how to balance yourself. So, I’m balanced and humbled as far as money goes.

How do you identify yourself as an investor?

I’m not such an adept investor because of the timeline. I’m a true Punjabi and I live life king-size. There are no shortcuts to making money, and the only way is the stock markets. The main thing in life after 59 years is that I’m very passionate about my job, and even though it’s very stressful, I’m having my best time now.

If you have to make money, you will have to constantly apprise yourself of changing parts of your business.

Download The Mint News App to get Daily Market Updates.

[ad_2]

Source link